Use A.I. to assist you and partners to find the best target audience during different market conditions, build social media marketing content and a structured marketing strategy.

Resource in use: ChatGPT https://openai.com/blog/chatgpt

***Never user customer data (names, addresses, etc) and 2. people should review the GPT response and edit it and be cautious on how to adopt the response, don't just assume the response is correct if you are asking GPT to make a decision

Finding Your Target Audience:

Ask A.I. for your target audience. See the example below.

A.I. Generated Response:

As you become more comfortable using the technology, you will be able to specify your niche and tailor your questions toward that niche.

2. Find your specific target audience based on current market conditions.

Because this A.I. function has limited knowledge of current market conditions, we simply need to inform the A.I. system of the market we are in to get our desired answers. See below for an example.

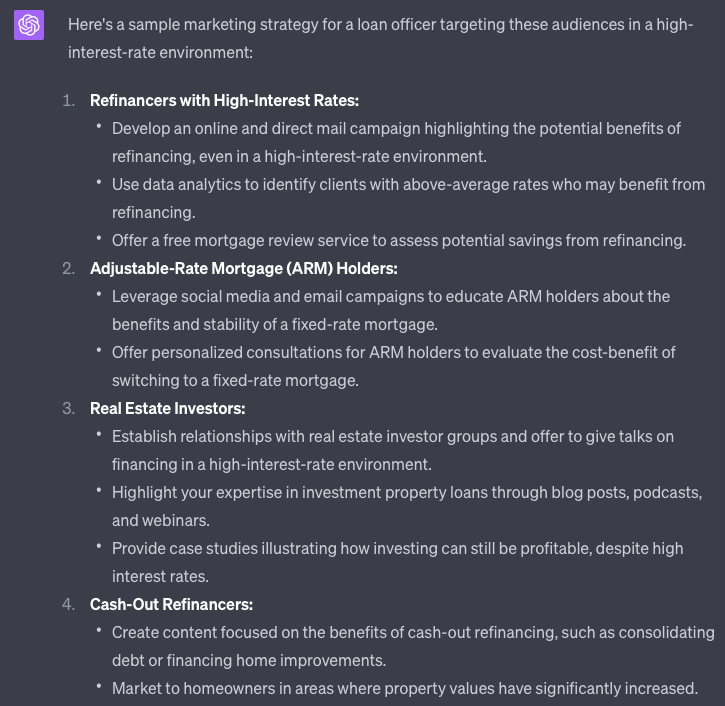

A.I. Generated Response:

3. Building a Marketing Strategy

To build a marketing strategy we can use on social media, we simply ask the A.I. bot to create social media content with the target audiences it just gave us. We do this by copy and pasting the information it generated previous and phrasing it as a question. See the example below:

USe A.I. To develop specific topics to target audiences more effectively.

The Following is the A.I. Generated Response:

Create Social media posts with these specific topics

Similar to the previous steps, use the A.I. generated response and include that in your follow up question about creating social media posts.

The Following is the A.I. Generated Response:

Use A.I. to help you create a posting schedule to target each audience.

Similar to the previous steps, use the A.I. generated response and include that in your follow up question about creating social media posting schedule.

The Following is the A.I. Generated Response:

4. Talking Topics and Sale’s Scripts

For in person meetings, we want to add value to our clients and partners. When we have scheduled one on one’s, webinars, or pop by’s, we can bring unexpected value to these meetings. Use A.I. to develop sales scripts, talking topics, articles and more.

See Examples below:

The Following is the A.I. Generated Response:

Opportunity Amidst High-Interest Rates: A Guide for Real Estate Investors

In a fluctuating economic landscape, the rising interest rates may seem like a deterrent to prospective real estate investors. However, experienced investors understand that opportunities are often hidden amidst perceived challenges. Let's uncover why buying a home in a high-interest-rate environment can be advantageous for real estate investors.

Rising Rents

During periods of high interest rates, the costs of homeownership tend to rise, causing more people to remain in the rental market. This increased demand for rental properties can lead to rising rents, which can offset the higher costs of a mortgage. As a real estate investor, this means your rental income could increase, helping to cover the mortgage costs, and potentially leading to greater profitability.

Greater Negotiation Power

In a high-interest-rate environment, fewer people may be willing or able to buy homes. This decrease in demand can put downward pressure on home prices, giving investors more room to negotiate. As a savvy investor, you can leverage these conditions to secure properties at more favorable prices.

Long-term Appreciation

Real estate is typically a long-term investment. While interest rates may be high now, property values have historically tended to rise over the long term. Therefore, even if the cost of borrowing is higher now, the potential for property value appreciation can provide significant returns over time.

Fixed-Rate Mortgages

Even in a high-interest-rate environment, fixed-rate mortgages offer the benefit of predictable costs. Once you lock in your rate, your mortgage payments remain the same over the life of the loan. This can make long-term financial planning easier for real estate investors.

Cash Flow vs. Capital Gain Strategy

In a high-interest-rate environment, adopting a cash flow strategy as opposed to a capital gain strategy may be beneficial. Investors can focus on properties in high-demand rental areas that can yield steady rental income (cash flow) instead of counting on the property's value to rise quickly (capital gain).

Availability of Distressed Sales

Higher interest rates can lead to an increase in distressed sales or foreclosures as some homeowners struggle to meet their mortgage obligations. These properties can often be purchased below market value, representing potential investment opportunities.

Tax Deductions

Investors can typically deduct mortgage interest and other property-related expenses from their taxable income, which can help offset the costs of higher interest rates.

In conclusion, while a high-interest-rate environment brings certain challenges, it also presents opportunities for resourceful real estate investors. It's crucial to understand these dynamics and adopt strategies that can turn these conditions to your advantage. Establishing relationships with real estate groups, attending talks on financing, and keeping informed through blog posts, podcasts, and webinars can help investors navigate this landscape effectively. By understanding how to leverage these situations, real estate investors can continue to thrive, irrespective of the prevailing interest rates.

Another example for a different Target Audience:

A.I. Generated Response:

Navigating High Interest Rates: A Guide for First-Time Home Buyers

Entering the housing market for the first time is an exciting milestone, but in a high-interest-rate environment, it can also seem daunting. As interest rates rise, the cost of borrowing increases, which may cause some first-time buyers to second-guess their decision. However, there are several reasons why buying a home during this time can still be a beneficial move.

1. Lower Competition

During periods of high interest rates, there can be a decrease in the overall number of buyers, which often results in less competition for properties. This less competitive market can give first-time home buyers more room to negotiate on price, which may offset the impact of higher interest rates.

2. Potential for Lower Housing Prices

In a high-interest-rate environment, fewer people are able to afford a mortgage, leading to decreased demand. This can exert downward pressure on housing prices. Thus, while you may pay more in interest, you could potentially secure a property for a lower price than you could during a period of low-interest rates.

3. Opportunity for Rate Decreases

Interest rates can be unpredictable and fluctuate over time. If rates are high when you initially get your mortgage, they could potentially decrease in the future. Some buyers opt for an adjustable-rate mortgage (ARM), which could allow for a lower rate in the future, although it's crucial to understand the terms as rates could also increase. Another option is refinancing if rates drop significantly in the future.

4. Building Equity

Even with higher interest rates, with each payment you make, you're building equity in your home. Over time, this can be a worthwhile investment, as you're putting money towards something you own, rather than paying rent to a landlord. Also, real estate generally appreciates over time, which means your home could be worth significantly more in the future.

5. Rental Income Potential

If you purchase a property with additional living space, such as a basement suite or a granny flat, you could consider renting it out. The additional rental income can help offset your higher mortgage payments.

6. Inflation Hedge

Real estate can serve as an excellent hedge against inflation. When inflation is high, it erodes the value of money. However, traditionally, real estate appreciates at a rate comparable to or higher than inflation. Buying a property can safeguard your wealth from the effects of inflation.

7. Tax Benefits

As a homeowner, you're entitled to several tax benefits that aren't available to renters. Depending on your situation, you may be able to deduct mortgage interest, property taxes, and other costs, which could help offset the impact of higher interest rates.

In conclusion, while buying a home in a high-interest-rate environment presents challenges, it also offers unique opportunities. With careful planning and the right resources - such as homebuyer seminars, mortgage calculators, loan comparison tools, and advice from experienced real estate agents - first-time buyers can successfully navigate the process. Remember, buying a home isn't just a purchase; it's an investment in your future. Even in a high-interest-rate environment, the potential benefits can make this investment worthwhile.

Creating a sales script to a specific audience:

Here is an example of a prompt to ask the A.I. Bot:

Here is the A.I. Generated Response:

Sure, here's a sample script for a loan officer talking to an investor. It's important to be professional, personable, and informative when talking to potential clients.

(Phone Rings, the Investor picks up)

Investor: Hello?

Loan Officer (LO): Hi, this is [Your Name] from [Your Company Name]. May I please speak to [Investor's Name]?

Investor: Speaking.

LO: Hi [Investor's Name], I hope this call finds you in good health. I recently learned about your interest in expanding your investment portfolio. How's your day going?

Investor: It's going fine, thank you. How can you assist me?

LO: Great to hear! As a loan officer with [Your Company], I work with investors like yourself to help them find the most beneficial financial solutions for their investment projects. I understand that each investor's needs are unique, and our aim is to provide customized loans that suit your specific needs.

Investor: Okay, that sounds interesting. But why should I consider working with you?

LO: Excellent question. Firstly, we have a broad spectrum of loan products that are designed to cater to diverse investment objectives. This means we can offer more flexibility and options than many other lenders.

Secondly, we pride ourselves on our competitive rates and transparent fee structures. There won't be any hidden fees or surprises down the line.

Lastly, our team's experience and knowledge in real estate and investment properties are second to none. We offer personal guidance throughout the loan process, ensuring you have a smooth and efficient experience.

Investor: Well, that's quite impressive. How do we proceed?

LO: I'm glad you're interested. The next step would be to set up a meeting where we can discuss your specific investment goals and explore potential loan options that best meet your needs. This can be done in person, over the phone, or even via a video conference at a time convenient for you.

Investor: That sounds like a plan.

LO: Perfect! I will send you an email with my available slots, and you can pick a time that works best for you. In the meantime, feel free to ask any questions you may have.

Investor: Thank you, [Your Name]. I will look out for your email.

LO: You're welcome, [Investor's Name]. I look forward to working with you. Have a great day!

Investor: You too, goodbye!

LO: Goodbye!

Remember, it's crucial to make the conversation about the investor and their needs rather than a direct sales pitch about your company's offerings. Adjust this script as needed to suit your style and your company's services.